CM Punjab Kisan Card Loan Limit Increased to Rs 3 Lakh – Big Relief for Farmers

punjab-kisan-card-loan-limit-increased-rs3-lakh In a major announcement for the agricultural community, the Punjab Government has officially increased the loan limit of the CM Punjab Kisan Card from Rs 150,000 to Rs 300,000 (3 Lakh). This move aims to provide greater financial flexibility to small and medium-scale farmers who were previously unable to meet their full cultivation expenses with the earlier loan cap.

Under the revised scheme, registered Kisan Card holders will now be able to borrow up to Rs 3 Lakh per crop season at subsidized or zero-interest rates, depending on their eligibility category. This enhanced credit facility can be used for fertilizers, seeds, pesticides, diesel, machinery rent, livestock feed, or even emergency recovery in case of crop damage.

The punjab-kisan-card-loan-limit-increased-rs3-lakh Rs 150,000 loan limit was insufficient, especially for cotton, rice, wheat, and sugarcane cultivation, which require higher input costs. By doubling the loan ceiling, the Punjab Government has provided a huge financial cushion that will help farmers avoid private moneylenders and high-interest loans.

The punjab-kisan-card-loan-limit-increased-rs3-lakh will be disbursed through partnered banks such as ZTBL, BOP, and HBL, and farmers will be able to withdraw funds directly via ATM or POS machines using their Kisan Card. Those who have already been approved under the older limit will be automatically upgraded, provided they have a clean repayment record.

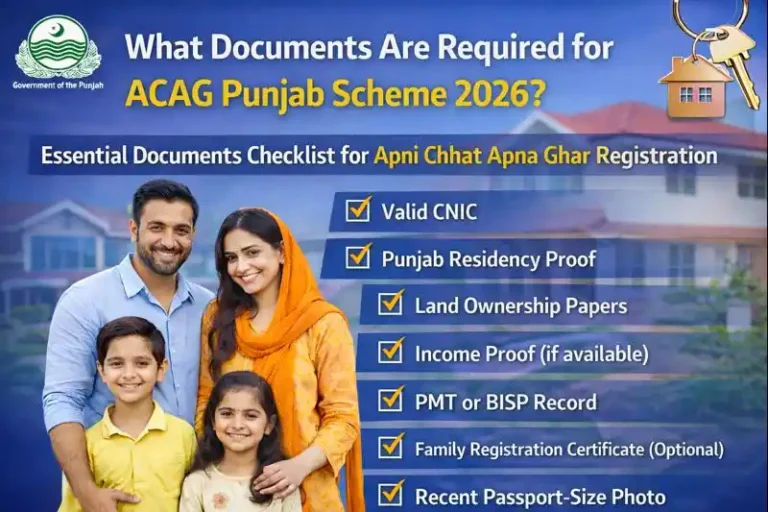

Read Also: ACAG for Government Employees – Quota, Eligibility & Benefits 2025

This decision is expected to boost agricultural productivity, stabilize crop supply, and reduce financial stress during peak sowing seasons. It is also a strategic step towards self-reliant and digitally empowered agriculture in Punjab.

Check Also: ACAG Phase 2 Latest Updates – Expected Launch Date & Details 2025

If you are a registered farmer or planning to apply soon, this is the perfect time to understand the new loan structure, eligibility rules, and activation process.

✅ Eligibility Criteria for Rs 3 Lakh Kisan Card Loan:

- Must be a registered Kisan Card holder in Punjab.

- CNIC and mobile number must be BVS-verified.

- Land record must be verified in PLRA (Arazi Record Center).

- For tenant farmers, lease or crop-sharing proof is required.

- Applicant must have no previous loan default or bank fraud record.

- Clean repayment history required for limit upgrade.

- Bank account in ZTBL / BOP / HBL recommended.

- Must agree to repay loan within 6–12 months depending on crop cycle.

🌾 Key Benefits of Increased Loan Limit:

- Higher purchasing power for seeds, fertilizers, diesel, and machinery.

- Freedom from private moneylenders and high-interest loans.

- Automated subsidy deduction on agri-input purchases.

- Instant ATM withdrawal or shop payments via POS machine.

- Flexible repayment options according to crop cycle.

- Eligible for crop insurance and disaster support programs.

- Special quotas for women and tenant farmers.

- Priority access to tractor and solar tube well schemes.

📝 How to Apply for Rs 3 Lakh Loan via CM Kisan Card:

- Visit your nearest ZTBL / BOP / HBL branch with CNIC and Kisan Card.

- Request Loan Limit Upgrade Form or apply via Kisan Portal.

- Provide land record / tenancy proof if required.

- Complete biometric verification.

- Bank will check repayment history & eligibility score.

- If approved, loan limit will be upgraded from 1.5 Lakh to 3 Lakh.

- Withdraw from ATM / POS / Agri Dealer as per need.

- Repay within agreed time to continue eligibility.

FAQs:

Q1: Will existing Kisan Card holders be upgraded automatically?

Yes, if repayment record is clean. Otherwise, fresh verification is needed.

Q2: Is the Rs 3 Lakh loan interest-free?

It depends on crop category — some loans are zero-interest, others are subsidized.

Q3: Can tenant farmers avail the increased limit?

Yes, if they provide valid lease or crop-sharing documentation.

Q4: How many times can I avail the loan in a year?

Up to two crop cycles — Rabi and Kharif.

Q5: Can I withdraw full 3 Lakh at once?

Yes, but partial withdrawal is recommended for better management.

Q6: What happens if I fail to repay on time?

Your card may be blocked and eligibility revoked.

Q7: Will I get SMS notification after upgrade?

Yes, confirmation SMS will be sent by the bank.

Q8: Can I reapply if rejected?

Yes, after clearing pending dues or updating information.

Q9: Are livestock farmers eligible too?

Yes, loan can be used for cattle feed and shed maintenance.

Q10: Is physical bank visit mandatory?

Yes, for biometric upgrade — online approval may come later.

Conclusion:

The increase in CM Punjab Kisan Card loan limit to Rs 3 Lakh is a gamechanger for farmers, especially those struggling with rising input costs. It not only empowers smallholders but also ensures that no farmer is left financially helpless during peak farming seasons.

By providing easy loans at minimal or zero interest, the government has effectively eliminated the role of exploitative middlemen and loan sharks. This initiative will stabilize the rural economy, boost crop production, and strengthen food security across Punjab.

The CM Punjab Kisan Card 2025 is more than just a government scheme — it is a practical solution to financial instability in agriculture. By introducing interest-free loans and digital access to subsidies, the government has made it possible for farmers to invest confidently in their crops without the fear of debt or exploitation.

However, the real benefit of this initiative lies in timely registration and responsible usage. Those who apply early and repay their loans on schedule will continue to receive higher limits, priority support, and access to new subsidy-based programs in the future.

Every successful farmer begins with a strong foundation — and today, that foundation is the Kisan Card. If you truly wish to upgrade your farming journey, this is the right moment to take action.

Register, activate your benefits, and grow with financial independence. The future of farming belongs to those who move forward.