NADRA Verification Issues During Housing Loan Processing

Applying for a housing loan in Pakistan can be exciting, but when NADRA Verification Issues appear during the process, the entire file gets delayed. Many applicants face problems such as unmatched CNIC data, wrong address, incomplete family tree, or biometric verification failures. These issues directly stop the bank from forwarding the loan file to the next stage, which causes stress and unnecessary delays. If you have ever applied for a mortgage, Islamic home finance, or government housing scheme, you might already be familiar with these problems.

Banks rely heavily on CNIC data to approve housing loans. Any inaccurate or outdated information can cause NADRA Verification Issues at multiple stages. Even minor mistakes like spelling errors, old address, incomplete fingerprints, or outdated marriage status make verification fail instantly. Understanding these NADRA problems — and knowing how to fix them quickly — is the key to keeping your loan file moving. For more housing loan guidance, detailed updates, and latest eligibility information, you can also check https://apnichatapnaghar.pk/ anytime.

Most borrowers do not know that NADRA verification is one of the most sensitive checks in housing loan processing. If NADRA Verification Issues appear in the first stage, the bank cannot proceed with biometric, income verification, property evaluation, or credit history checks. This makes it extremely important to fix your NADRA data before applying for any type of housing loan.

Why NADRA Verification Is Important in Housing Loan Processing

Banks must follow strict SBP (State Bank of Pakistan) rules. NADRA checks ensure:

- Your identity is verified

- Your fingerprints match the NADRA database

- No fraudulent identity is used

- CNIC data and home address are valid

- Family information is correct

- Marital status is up-to-date

- Biometrics are clean and readable

If any mismatch occurs, the bank system immediately stops processing the loan file.

Check Also: How Banks Check Your Credit History Before Housing Loan

Most Common NADRA Verification Issues During Housing Loan Processing

Below are the issues applicants face most frequently:

1. CNIC Address Mismatch

If your CNIC address is different from your current address or property location, verification can fail.

2. Fingerprint/biometric mismatch

Common in elderly applicants or individuals with worn fingerprints.

3. NADRA database not updated

Name spelling, family number, or marital status not updated.

4. Old CNIC or Smart CNIC not issued

Banks prefer Smart CNIC; older laminated CNIC often cause delays.

5. Family tree (FRC) errors

Incorrect information in Family Registration Certificate.

6. CNIC expiry

Expired CNIC automatically blocks housing loan verification.

7. Data entry error by NADRA

Mistakes made during your CNIC creation or update.

8. Incomplete biometric in NADRA database

Many people have partial biometrics due to old records.

These problems create confusion for the bank and force them to hold your file.

Check Also: Punjab Govt Simplifies Home Loan Registration 2025 – 20% Discount Offer!

How to Check NADRA Verification Status Before Applying for a Housing Loan

A smart step is to verify your NADRA information BEFORE applying.

You can check:

- CNIC details on NADRA SMS service (8400)

- Biometric verification at a NADRA office

- Family Tree (FRC)

- CNIC expiry date

- Address status

- Marital status

- Fingerprint strength

Doing this early prevents 90% loan delays.

Step-by-Step Solution For NADRA Verification Issues During Loan Processing

Follow this complete solution guide:

Step 1: Visit NADRA Registration Centre for Biometric Check

Ask the operator to verify:

- Fingerprints

- Biometric matching strength

- Status of your CNIC

- Status of Smart ID issuance

If biometric is weak, request the biometric improvement procedure.

Step 2: Update Incorrect CNIC Information

Update the following if incorrect:

- Name spelling

- Father’s or husband’s name

- Current home address

- Date of birth

- Marital status

- Family details

Banks require accurate and updated information.

Step 3: Renew Expired CNIC Immediately

Expired CNIC = automatic loan file rejection.

NADRA offers urgent renewal with faster processing.

Step 4: Fix Address Issues Immediately

If your CNIC address is outdated, change it to your current residential address.

Banks may ask for:

- Utility bill

- Rent agreement

- Affidavit

- Property ownership document

Make sure your address is uniform across all documents.

Step 5: Request NADRA for “Fingerprint Re-capture”

If biometric doesn’t match at the bank:

- NADRA will re-capture fingerprints

- Upload new images to system

- Improve your verification strength

This fixes most biometric failures.

Step 6: Update Marital Status or Family Tree

For married applicants:

- Ensure spouse name is updated

- Ensure NICOP status (if abroad) is correct

For unmarried applicants:

- Ensure parents’ information matches NADRA family tree

Banks verify this strictly.

Step 7: Provide NADRA-Verified Documents to the Bank

After fixing everything, get:

- Updated CNIC

- Updated FRC

- Proof of biometric re-capture

- CNIC copy with updated address

Submit these to the bank for re-verification.

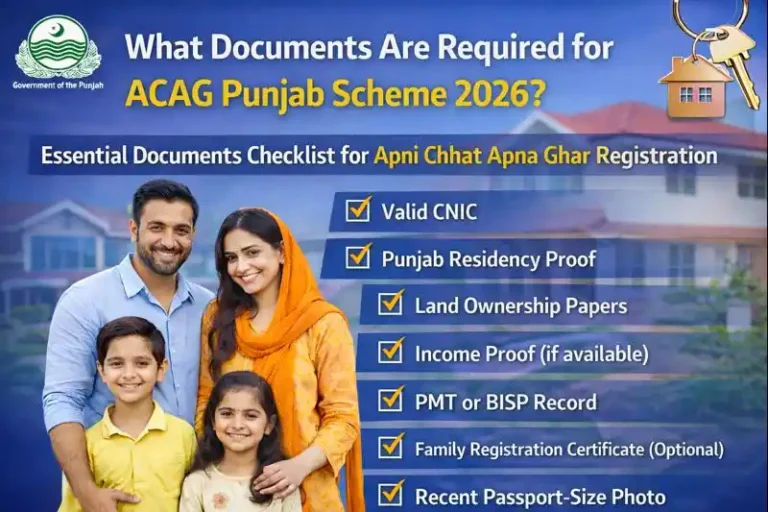

Documents Required for Verification During Housing Loan Processing

Banks usually need:

- CNIC (updated)

- Smart CNIC copy

- Expiry date clear

- Fresh biometric

- Family Registration Certificate (if required)

- Proof of address

- Employment/income documents

- Property documents

- Salary slip or bank statement

Make sure your NADRA details match your documents.

How Banks Verify NADRA Information

Banks use advanced verification systems:

- NADRA online verification portal

- Biometric device

- SBP compliance systems

- Anti-fraud checks

If the system detects inconsistency, verification fails instantly.

What Happens When NADRA Verification Fails?

When verification fails:

- Loan file is marked “Incomplete”

- Processing is stopped

- Bank requests correction

- File is moved to pending queue

- Delay increases (up to 30+ days)

Fixing NADRA info quickly reduces delays.

How Long NADRA Updates Take?

- Biometric update → immediately active

- Address change → 7–10 working days

- Marital status update → 7 days

- CNIC renewal → 7–15 days

- Smart CNIC urgent → 2–3 days

- Family Tree correction → 3–7 days

- Name change → 10–15 days

Plan your loan application accordingly.

Tips to Avoid NADRA Verification Issues in the Future

- Always keep your CNIC updated

- Shift to Smart CNIC

- Update address before applying

- Re-check FRC details

- Keep biometric strong

- Ensure no spelling mistakes

- Never apply for loan with expired CNIC

- Respond quickly to bank queries

Check Also: Top Mistakes That Cause Apni Chhat Apna Ghar Loan Rejection

Frequently Asked Questions (FAQs) about NADRA Verification Issues During Housing Loan Processing:

1. Why does NADRA verification fail?

Because of mismatched CNIC data, weak biometrics, or outdated information.

2. Can the bank see my NADRA details?

Yes, banks use NADRA’s official verification system.

3. How do I fix biometric issues?

Visit NADRA centre and request fingerprint re-capture.

4. Is Smart CNIC mandatory for housing loans?

Yes, nearly all banks require Smart CNIC for verification.

5. Does wrong address cause loan delay?

Yes, address mismatch can stop your loan file for weeks.

6. How long NADRA updates take?

Most updates take 3–15 days depending on type.

7. What if NADRA system is down?

Banks will retry verification once the system becomes active.

Conclusion – NADRA Verification Issues During Housing Loan Processing

Fixing NADRA Verification Issues is one of the most important steps in housing loan processing. Any mismatch in CNIC, address, biometric, or family tree can stop the bank from moving your file forward. By updating your NADRA records on time, checking biometric accuracy, and ensuring all details match your bank documents, you can avoid long delays and get your loan approved smoothly.

If you are applying for a housing loan or need updates about government housing schemes, keep visiting platforms like https://apnichatapnaghar.pk/ for the latest information and guides.