Maryam Nawaz Asaan Loan Scheme 2025 – Apply Online for Easy Business & Education Loans in Punjab

The Maryam Nawaz Asaan Loan Scheme 2025, under the visionary leadership of Chief Minister Maryam Nawaz Sharif, has launched the Maryam Nawaz Asaan Loan Scheme 2025 to promote financial independence, entrepreneurship, and higher education. This initiative provides interest-free and low-markup loans to students, small business owners, and young entrepreneurs who want to start or expand their businesses.

Through this scheme, the Punjab government aims to encourage youth participation in Pakistan’s growing economy and create self-employment opportunities across rural and urban areas. The loans are designed to be easily accessible via a digital application portal, ensuring transparency and equal opportunities for all citizens.

The Asaan Loan Scheme is part of the Punjab Employment Program (PEP) and complements other welfare initiatives like the Green Tractor Scheme, e-Bike Scheme, and Youth Skill Development Program.

Key Features of Maryam Nawaz Asaan Loan Scheme 2025

- Interest-Free or Low Markup Loans – Depending on the category, applicants can access loans without paying any interest or with minimal service charges.

- Easy Digital Application Process – Applicants can apply online from home through the official Punjab portal.

- Targeted for Youth and Women – Special quotas are reserved for female entrepreneurs, students, and skilled youth.

- Multiple Loan Categories – Loans are available for business startups, education, agriculture, and technical training.

- Flexible Repayment Plans – Repayment periods range from 3 to 5 years with convenient installment options.

- Government-Backed Initiative – 100% verified and supported by the Punjab Small Industries Corporation (PSIC) and Bank of Punjab (BOP).

- No Collateral for Small Loans – Micro-level borrowers can apply without any property or asset guarantees.

Loan Amount Categories under Asaan Loan Scheme:

| Category | Loan Amount | Interest Rate | Repayment Period | Target Group |

|---|---|---|---|---|

| Tier 1 | Rs. 100,000 – Rs. 500,000 | 0% (Interest-Free) | 3 Years | Students & Micro Entrepreneurs |

| Tier 2 | Rs. 500,000 – Rs. 1,000,000 | 3% Markup | 4 Years | Small Business Owners |

| Tier 3 | Rs. 1,000,000 – Rs. 2,000,000 | 5% Markup | 5 Years | Established Entrepreneurs |

| Tier 4 | Rs. 2,000,000 – Rs. 5,000,000 | 7% Markup | 5 Years | SMEs & Expansion Projects |

Eligibility Criteria for Maryam Nawaz Asaan Loan Scheme 2025:

Applicants must fulfill the following eligibility requirements before applying online:

- Nationality – Must be a citizen of Pakistan with a valid CNIC.

- Domicile – Must be a resident of Punjab province.

- Age Limit – Between 18 to 45 years for general applicants; up to 50 years for women and differently-abled persons.

- Educational Qualification – Minimum Matric or Intermediate, depending on loan purpose.

- Business Plan – Applicants must submit a simple and feasible business plan or project proposal.

- Credit History – No default history with any bank or financial institution.

- Gender Inclusion – 30% quota reserved for female applicants.

Documents Required for Asaan Loan Application:

Before starting the online application, keep these documents ready:

- CNIC (Computerized National Identity Card)

- Domicile certificate

- Recent passport-size photographs

- Business plan or proposal

- Educational certificates (if applicable)

- Proof of income (if employed)

- Bank account details

- Utility bill (for address verification)

Check Also: ACAG Helpline & Complaint Portal Report Issues Online Easily 2025

How to Apply Online for Maryam Nawaz Asaan Loan Scheme 2025

Follow the step-by-step process to register for the Asaan Loan Scheme via the official portal:

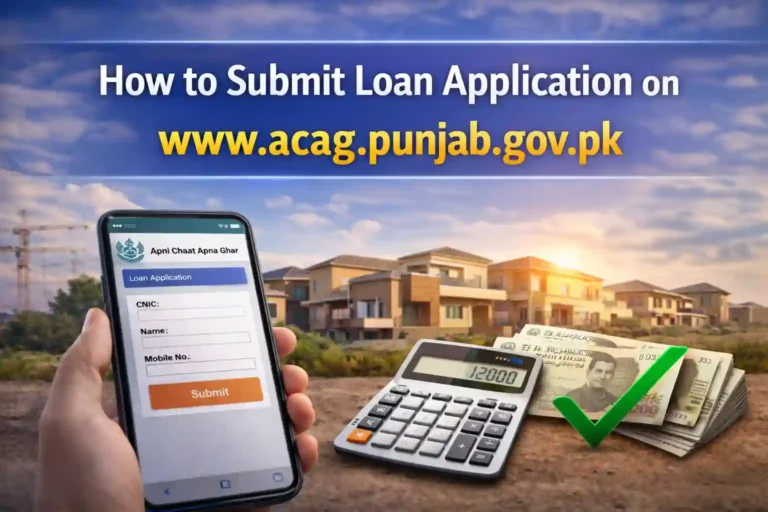

- Visit the Official Website – Go to the Punjab Government Loan Portal at https://pave.com.pk or https://pavegov.com.pk.

- Create an Account – Click “Sign Up” and enter your CNIC, email, and mobile number to register.

- Login to the Portal – Verify your account and login to the dashboard.

- Select Loan Type – Choose your preferred category (business, education, or agriculture).

- Fill Application Form – Enter your personal, educational, and business details accurately.

- Upload Documents – Attach scanned copies of CNIC, photos, and business plan.

- Submit Application – Review your form and click “Submit.”

- Verification & Approval – The system will verify your details via NADRA and forward them to the Bank of Punjab for processing.

- Loan Disbursement – Once approved, the loan amount is transferred directly to your bank account.

Benefits of Maryam Nawaz Asaan Loan Scheme Punjab 2025:

- Promotes Youth Employment – Encourages young individuals to start their own businesses instead of waiting for government jobs.

- Women Empowerment – Supports women-led startups, home-based businesses, and educational financing.

- Interest-Free Opportunity – Helps low-income citizens grow financially without paying extra interest.

- Economic Growth – Boosts the provincial economy through new enterprises and job creation.

- Digital & Transparent System – Reduces corruption by using an online, trackable application portal.

- Collaboration with Banks – Smooth coordination with BoP, PSIC, and SMEDA ensures financial discipline.

- Skill Development Support – Applicants can use loans for technical and vocational training as well.

Objectives of the Scheme 2025:

- Reduce unemployment and poverty in Punjab

- Encourage entrepreneurship among educated youth

- Empower women through business ownership

- Support small and medium enterprises (SMEs)

- Promote financial inclusion through easy access to credit

Read Also: Common ACAG Document Mistakes That Lead to Rejection – Checklist 2025

Partner Banks and Departments 2025:

- Bank of Punjab (BoP) – Main disbursement and verification partner

- Punjab Small Industries Corporation (PSIC) – Application assessment and technical support

- Punjab Information Technology Board (PITB) – Manages the online application system

- SMEDA (Small and Medium Enterprise Development Authority) – Provides business consultancy

Expected Timeline for Loan Processing:

| Stage | Timeline |

|---|---|

| Online Application Submission | Immediate |

| Document Verification | 7 – 10 Days |

| Bank Evaluation | 15 – 20 Days |

| Loan Approval | Within 30 Days |

| Disbursement | 5 – 7 Working Days After Approval |

Contact Information

📍 Official Portal: https://pave.com.pk

📞 Helpline: 042-111-333-267

🏢 Address: Punjab Small Industries Corporation, Lahore, Punjab, Pakistan

🕓 Office Hours: Monday to Friday – 9:00 AM to 5:00 PM

Conclusion – A New Era of Financial Inclusion in Punjab:

The Maryam Nawaz Asaan Loan Scheme 2025 is a major step toward creating a financially strong and self-reliant Punjab. With easy access to funds, young people can transform their innovative ideas into successful businesses. The government’s commitment to empowering women and promoting digital transparency has made this program one of the most progressive financial initiatives in Pakistan’s history.

Through this scheme, the Punjab government envisions a future where no deserving citizen is left behind due to a lack of financial support. Whether you’re a student, a small business owner, or a young entrepreneur — this is your chance to build your future with interest-free, easy, and transparent financing.

Read Also: ACAG Phase 2 Latest Updates – Expected Launch Date & Details 2025

FAQs – Maryam Nawaz Asaan Loan Scheme 2025:

1. What is the main purpose of the Maryam Nawaz Asaan Loan Scheme?

The scheme aims to provide financial support to youth and women for starting small businesses, pursuing education, or expanding existing enterprises.

2. Who can apply for this loan?

Any Punjab resident aged between 18 and 45 years with a valid CNIC and a viable business or education plan can apply.

3. Is the loan interest-free?

Yes, small loans up to Rs. 500,000 are completely interest-free, while higher tiers have very low markup rates.

4. How can I apply online?

Visit the official portal https://pave.com.pk, create an account, fill the application form, upload documents, and submit online.

5. Is there any application fee?

No, the registration and application process is completely free of cost.

6. Can women apply separately?

Yes, 30% of the total quota is reserved exclusively for women entrepreneurs and students.

7. What is the repayment duration?

Depending on the loan category, repayment periods range from 3 to 5 years.

8. Which banks are involved in this scheme?

The Bank of Punjab (BoP) is the main financial partner handling verification and disbursement.

9. Can students apply for educational purposes?

Yes, students can apply under the education loan category to pay for tuition, books, or training programs.

10. When will the application process start?

The portal is expected to open in early November 2025, as announced by the Punjab government.