Breaking News: Khushhali Bank Announces Mera Ghar Mera Aashiyana Scheme 2025 – Get Home Loan Up to Rs. 35 Lakh at Just 5% Markup

Owning a home in Pakistan is now easier than ever. Under the Mera Ghar Mera Aashiyana Scheme 2025, the Government of Pakistan, in partnership with Khushhali Microfinance Bank, has launched an affordable housing finance facility. Through this initiative, low- and middle-income families can get home loans up to Rs. 35 lakh at a markup as low as 5% to build, purchase, or renovate their dream homes.

This government-subsidized program aims to make home ownership possible for every Pakistani, especially those struggling with rising construction costs and limited financing options. Let’s explore all details — eligibility, requirements, application process, benefits, and FAQs — for the Mera Ghar Mera Aashiyana Scheme 2025.

🏠 Overview of the Mera Ghar Mera Aashiyana Scheme 2025

| Feature | Details |

|---|---|

| Program Name | Mera Ghar Mera Aashiyana Housing Finance Scheme 2025 |

| Announced By | Government of Pakistan with Khushhali Microfinance Bank |

| Loan Limit | Up to Rs. 3.5 million (35 lakh) |

| Markup Rate | 5 % to 8 % (depending on loan tier) |

| Property Size Eligibility | Up to 5 marla house or 1,360 sq ft flat |

| Target Beneficiaries | Low and middle-income families nationwide |

| Processing Fee | Minimal and no pre-payment penalty |

| Partner Portal | https://smawi.sbp.org.pk |

| Official Bank | Khushhali Microfinance Bank |

🌟 Purpose of the Scheme

The Mera Ghar Mera Aashiyana Scheme 2025 is part of Pakistan’s long-term housing vision to provide affordable and accessible home finance. With inflation affecting construction and property prices, many families cannot afford down payments or high bank interest.

Through Khushhali Bank’s subsidized finance plan, the government offers a fixed low markup rate so citizens can build or purchase houses on easy monthly installments. This step is designed to promote economic stability, generate employment in the construction sector, and ensure housing security for Pakistan’s growing population.

Check Also: Housing Loan Interest Rate Comparison for 2025 – Full Breakdown of Banks & Schemes

🧾 Eligibility Criteria for Applicants

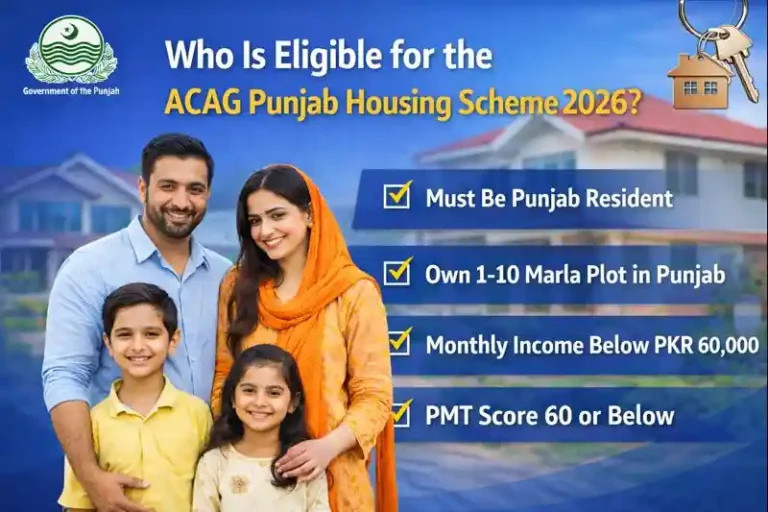

To qualify for the Mera Ghar Mera Aashiyana Scheme 2025, applicants must fulfill certain conditions. Below is the detailed eligibility table:

| Category | Eligibility Requirements |

|---|---|

| Citizenship | Pakistani citizen with valid CNIC |

| Age Limit | 25 to 60 years |

| Income Range | Low to middle-income earners (max monthly income ≤ Rs. 150,000) |

| Employment Status | Salaried or self-employed individuals |

| Property Ownership | Must not already own a house in their name |

| Loan Purpose | Purchase / construction / renovation of a house or flat |

| Property Type | Residential only (up to 5 marla or 1,360 sq ft) |

📋 Required Documents for Application

When applying through Khushhali Bank, applicants must attach these verified documents:

- Copy of CNIC (applicant and co-applicant if any)

- Recent passport-size photographs

- Proof of income / salary slip / business documents

- Bank statement for last 6 months

- Property documents / sale agreement / map

- Utility bills for residence verification

- Tax return (if applicable)

Applicants should ensure that all papers are up to date and legally verified before submission to avoid delays.

🪜 Step-by-Step: How to Apply for Mera Ghar Mera Aashiyana Scheme 2025

Follow this simple guide to apply for the subsidized housing loan:

- Visit Khushhali Microfinance Bank Website:

Go to www.khushhalibank.com.pk and find the Mera Ghar Mera Aashiyana section. - Download or Collect Application Form:

You can apply online or visit your nearest Khushhali Bank branch to obtain the form. - Attach Required Documents:

Include CNIC copies, income proof, property papers, and photographs. - Submit the Application:

Submit the complete form to the bank branch or upload through the State Bank’s official portal — https://smawi.sbp.org.pk. - Verification and Approval:

The bank verifies your eligibility, income, and property details. Once approved, a loan offer is issued. - Loan Disbursement:

After final documentation and agreement signing, the loan amount is released for your property purchase or construction.

Check Also: Apni Chhat vs Mera Pakistan Mera Ghar – Which Housing Scheme Is Better in 2025?

💰 Financing Tiers and Markup Rates

| Loan Category | Loan Amount Range | Markup Rate (% per annum) | Repayment Tenure |

|---|---|---|---|

| Tier 1 | Up to Rs. 2 million (20 lakh) | 5 % | Up to 20 years |

| Tier 2 | Rs. 2 million – Rs. 3.5 million (35 lakh) | 8 % | Up to 20 years |

| Prepayment Option | Allowed without penalty | — | — |

This flexible plan helps families manage repayments comfortably within their income.

🏡 Benefits of Mera Ghar Mera Aashiyana Scheme 2025

| Benefit | Details |

|---|---|

| Low Markup Rate | Fixed at only 5 – 8 %, far below market rate |

| High Loan Limit | Up to Rs. 35 lakh for home purchase or construction |

| Flexible Tenure | Repay in easy installments over up to 20 years |

| No Hidden Charges | Transparent processing, no extra service fees |

| Early Repayment Benefit | Settle loan any time without penalty |

| Wide Eligibility | For salaried and self-employed applicants |

| Secure Ownership | Legally protected property financing through licensed banks |

🧮 Example Calculation: Rs. 20 Lakh Loan

| Details | Example Calculation |

|---|---|

| Loan Amount | Rs. 2,000,000 (20 lakh) |

| Markup Rate | 5 % fixed |

| Tenure | 20 years (240 months) |

| Approx. Monthly Installment | Rs. 13,200 – Rs. 14,000 (depending on loan term) |

| Total Repayment | Around Rs. 3.2 million over 20 years |

Note: Exact installments vary slightly based on tenure and property value.

🧱 Property and Construction Conditions

Applicants can use the loan for:

- Building a new house on owned land (up to 5 marla)

- Purchasing a ready house or flat (up to 1,360 sq ft)

- Renovating or extending an existing residential unit

The property must be located within Pakistan and legally approved by local development authorities.

📞 Contact Information

Khushhali Microfinance Bank Limited

📍 Head Office: Islamabad, Pakistan

☎️ Helpline: 051-111-047-047

🌐 Website: www.khushhalibank.com.pk

💻 Apply Online: https://smawi.sbp.org.pk

🧩 Why Choose Khushhali Bank?

Khushhali Microfinance Bank has become one of the most trusted financial institutions in Pakistan’s housing finance sector. Its collaboration with the State Bank of Pakistan ensures that subsidized funding is transparent, secure, and accessible to ordinary citizens.

The bank’s focus on financial inclusion, women empowerment, and micro housing finance makes it a perfect partner for low-income families dreaming of home ownership.

Check Also: How Banks Verify Your Income for Housing Loan Approval

💡 Tips for a Successful Application

- Prepare all required documents before submission.

- Ensure your income and property details are accurate.

- Apply early to avoid delays in approval.

- Check the State Bank portal regularly for updates.

- Keep a record of all communication with the bank.

❓ FAQs About Mera Ghar Mera Aashiyana Scheme 2025:

1. What is the maximum loan limit under this scheme?

Up to Rs. 3.5 million (35 lakh) can be availed for house construction or purchase.

2. What is the markup rate?

Only 5 % for loans up to Rs. 2 million and 8 % for loans up to Rs. 3.5 million.

3. Who is eligible to apply?

Any Pakistani citizen aged 25–60 years who does not already own a house and falls under low or middle-income category.

4. Can self-employed people apply?

Yes. Self-employed and freelancers can apply by showing proof of regular income.

5. Is there any down payment required?

Yes, a small equity contribution may be required based on property value.

6. Can I repay the loan early?

Yes. Khushhali Bank allows early repayment without any extra charges.

7. Can the loan be used for renovation only?

Yes. You can apply for renovation or extension of an existing house as well.

8. Where can I apply online?

Through https://smawi.sbp.org.pk or visit any Khushhali Bank branch across Pakistan.

🏁 Conclusion – Khushhali Bank Announces Mera Ghar Mera Aashiyana Scheme 2025

The Mera Ghar Mera Aashiyana Scheme 2025 marks a significant milestone toward making housing affordable for Pakistan’s working class. With support from Khushhali Microfinance Bank and the Government of Pakistan, citizens can now secure home loans up to Rs. 35 lakh at a low markup of 5 %, making home ownership a reality instead of a dream.

If you’ve been waiting for the right time to buy or build your home, this is the perfect opportunity. Visit Khushhali Bank’s website or apply online via State Bank Portal (SMAWI) today and take the first step toward owning your dream home.