How Much Loan Is Offered Under Apni Chhat Apna Ghar Scheme 2026? (Complete Loan Details Guide)

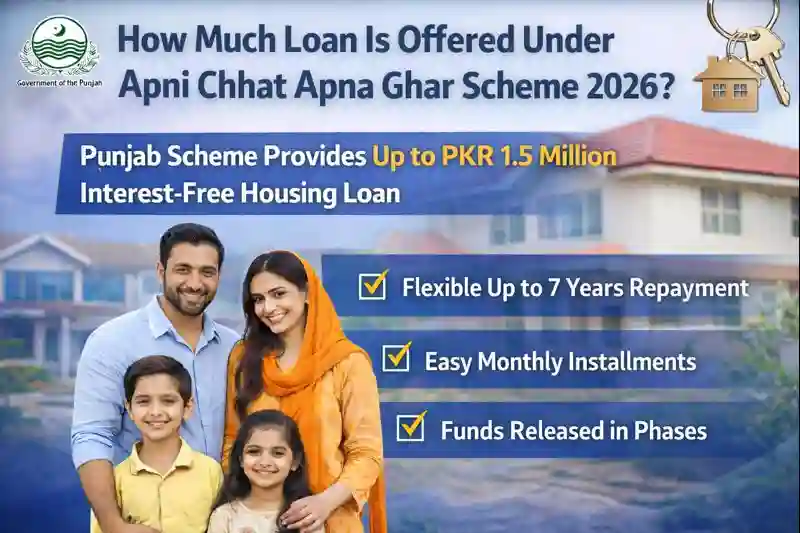

The Apni Chhat Apna Ghar (ACAG) Punjab Housing Scheme 2026 provides a powerful financial opportunity for low-income and middle-income families who cannot afford house construction expenses. Instead of depending on banks and high-interest loans, the Punjab Government offers interest-free financial assistance so deserving families can finally build their own homes.

This guide explains the loan amount, repayment plan, eligibility, approval process, and benefits of the ACAG housing loan.

✅ Maximum Loan Amount Under Apni Chhat Apna Ghar Scheme 2026

Under this scheme, eligible applicants can receive housing loan support of up to:

👉 PKR 1.5 Million (15 Lakh Rupees)

This financial support is given specifically for:

✔ Constructing a new house

✔ Completing an under-construction house

✔ Building safe and permanent shelter for the family

The final approved loan amount depends on:

- Plot Size

- Location (Urban or Rural)

- Type of Construction

- Estimated construction cost

- Verification results

- Government assessment

This ensures that the financial assistance is provided according to real needs and practical construction requirements.

Check Also: How to Apply Online for Apni Chhat Apna Ghar Program 2026? (Complete Registration Guide)

🏠 Who Can Get ACAG Punjab Housing Loan 2026?

The Apni Chhat Apna Ghar Loan is mainly designed for those families who:

✔ Do not own a permanent house

✔ Belong to low or middle-income category

✔ Are living in rented houses

✔ Are living with relatives due to financial problems

✔ Own land but cannot afford construction expenses

✔ Face financial burden and cannot take bank loans

This scheme supports urban as well as rural families across Punjab, ensuring equal opportunity and social protection for deserving citizens.

💰 Is the Apni Chhat Apna Ghar Loan Interest-Free?

Yes ✔️

This is one of the biggest strengths of the ACAG Punjab Housing Scheme 2026.

The loan provided under this program is:

✔ 100% Interest-Free

✔ No bank interest

✔ No hidden charges

✔ No additional financial burden

In normal bank loan systems, people have to pay double the actual amount due to interest. But under this government housing scheme, families only repay the actual loan amount, which makes it extremely affordable and beneficial for financially weak families.

Check Also: Punjab Workers Free Housing Scheme 2026 – 720 Flats Ready, New 1,872 Approved

🕒 Loan Repayment Duration – How Long Do You Get to Pay Back?

The Punjab Government has designed a very relaxed and supportive repayment system so that families do not feel financial burden.

Repayment Period:

👉 Up to 7 Years

This long repayment duration allows families to:

✔ Manage finances easily

✔ Pay through affordable installments

✔ Avoid financial stress

✔ Balance daily expenses and loan payment

Even low-income families can repay the loan comfortably due to a soft, citizen-friendly policy.

📆 Monthly Installment Structure – Estimated Repayment Idea

Although the exact monthly installment depends on the final loan amount and government policies, an estimated idea can be understood as follows:

| Loan Amount | Estimated Monthly Installment | Repayment Duration |

|---|---|---|

| PKR 500,000 | PKR 8,000 – PKR 12,000 | 7 Years |

| PKR 1,000,000 | PKR 14,000 – PKR 18,000 | 7 Years |

| PKR 1,500,000 | PKR 20,000 – PKR 26,000 | 7 Years |

Final installment structure may slightly vary depending on:

- Loan disbursement schedule

- Construction phases

- Financial capacity assessment

- Government policy updates

However, the most important point remains constant:

👉 The housing loan remains completely interest-free.

Check Also: Benefits of Low PMT Score for Women Applicants Complete Guide

🧱 How Is the Loan Released? – Phase-Wise Payment System

To ensure transparency and proper utilization of funds, the housing loan is usually released in multiple stages, not in a single lump sum.

Typical Loan Release Stages:

1️⃣ First Installment

For foundation, base structure and initial construction.

2️⃣ Second Installment

For walls, roofing, and main building structure completion.

3️⃣ Final Installment

For finishing, interior completion, and final development.

Government authorities and monitoring teams may visit or verify construction progress to ensure that the money is being used only for house construction, not for any other purpose. This prevents misuse of funds and ensures successful completion of the house.

📜 Basic Requirements to Receive ACAG Housing Loan

To qualify for the Apni Chhat Apna Ghar Loan 2026, applicants must:

✔ Be a resident of Punjab

✔ Have valid CNIC

✔ Own a residential plot in Punjab

✔ Have PMT Score 60 or below

✔ Belong to low or middle-income family

✔ Not already own a permanent house

✔ Provide genuine and verified documents

This ensures that the loan reaches only deserving and eligible families.

🔍 Loan Approval Process – Step-by-Step System

After submitting your application, the loan approval goes through a transparent, multi-step verification process.

Step 1 – Application Submission

Applicants submit online or offline application with complete details.

Step 2 – Initial Screening

Government checks:

- CNIC verification

- Residency confirmation

- Basic eligibility review

Step 3 – Detailed Verification

Authorities verify:

- Monthly income

- PMT score

- Land ownership legality

- Family details

- Social and financial assessment

Step 4 – Shortlisting or Balloting

If applications exceed available quota, a fair computerized selection takes place.

Step 5 – Bank & Financial Review

Partner banks or financial departments process and finalize loan approval.

Step 6 – Loan Disbursement

Approved applicants receive loan in easy phases.

This transparent process builds trust and ensures fair distribution of benefits.

Check Also: PSER in AZAG Scheme Registration – Mandatory Requirement Explained

❓ What Happens If Someone Fails to Pay Installments?

The Punjab Government follows a supportive approach instead of aggressive punishment.

✔ Grace period may be provided in genuine hardship

✔ Installments may be adjusted in special cases

However:

❌ Continuous non-payment

❌ Misuse of funds

❌ Fraudulent applications

may lead to:

- Stoppage of future installments

- Delay in final approval or completion

- Legal consequences in severe misuse cases

This ensures financial discipline and protects public funds.

⭐ Why This Loan Is a Big Relief for Families

The Apni Chhat Apna Ghar Loan 2026 offers life-changing advantages:

✔ Interest-free financial support

✔ Affordable installment plan

✔ Transparent approval process

✔ Government-backed security

✔ Relief from heavy rent burden

✔ Real chance to build a permanent home

✔ Better living standard and social dignity

For thousands of deserving families, this scheme turns an impossible dream into reality.

Conclusion – How Much Loan Is Offered Under Apni Chhat Apna Ghar Scheme 2026

The Apni Chhat Apna Ghar Scheme 2026 provides up to PKR 1.5 Million interest-free housing loan with a relaxed 7-year repayment plan, fair eligibility rules, and transparent approval process. This government-supported loan helps low-income families build their own safe, permanent and dignified homes without falling into heavy debt or bank interest traps.

If you meet the eligibility criteria, apply confidently, submit genuine documents, and stay updated with official announcements. This scheme is truly a golden opportunity to secure your family’s future.