How Banks Verify Your Income for Housing Loan Approval

Buying your own home is one of the biggest dreams in life, but before any bank or financial institution approves your loan, they carefully verify your income. Understanding how banks verify income for housing loan approval can help you prepare your documents properly and avoid rejection. In Pakistan, every housing loan under government or private schemes, including Apni Chhat Apna Ghar Scheme 2025, goes through a strict verification process to ensure applicants can repay comfortably.

The banks verify income for housing loan approval by checking your monthly salary, employer details, bank statements, and tax records. This process helps the bank assess your financial stability and creditworthiness before granting funds. Whether you are a salaried employee or a self-employed person, having transparent income proof increases your chances of loan approval.

When you apply for a housing loan through Apni Chhat Apna Ghar Scheme 2025 or any bank financing, you must know that banks verify income for housing loan approval to prevent default risks. This means your documents must be accurate, consistent, and verifiable through your employer or FBR records.

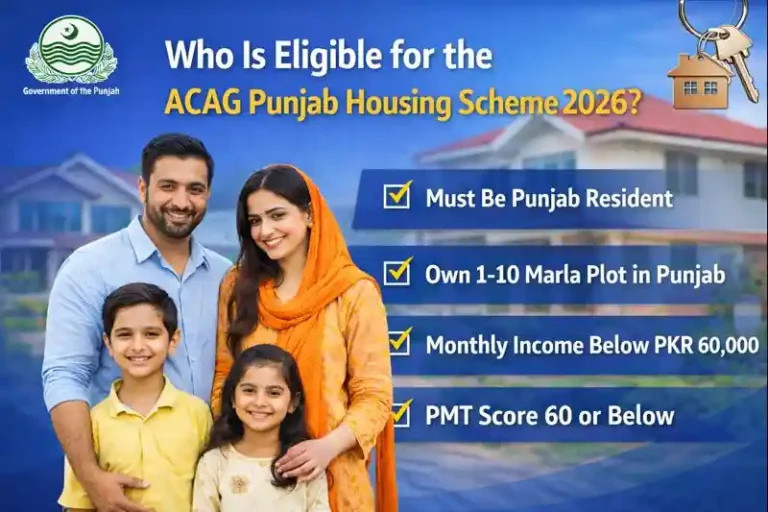

Eligibility Criteria for Apni Chhat Apna Ghar Scheme 2025

| Category | Eligibility Details |

|---|---|

| Nationality | Pakistani citizen with valid CNIC |

| Employment Type | Salaried or self-employed individual |

| Minimum Income | Rs. 35,000 per month (may vary by bank) |

| Job/Business Duration | At least 2 years in current role/business |

| Credit Score Requirement | Clean repayment history preferred |

| Age Limit | 21 to 60 years (for salaried), up to 65 (for business owners) |

Check Also: Apni Chhat vs Mera Pakistan Mera Ghar – Which Housing Scheme Is Better in 2025?

Required Documents for Income Verification

To complete the income verification process, banks require the following documents depending on your employment status:

| Type | Required Documents |

|---|---|

| Salaried Person | CNIC copy, last 3 salary slips, employer verification letter, 6-month bank statement, tax return (if applicable) |

| Self-Employed Person | CNIC copy, business registration certificate, last 12-month bank statement, income tax return, utility bills of business premises |

| Government Employee | Service certificate, salary slip, DDO letter, CNIC, and pension record (if applicable) |

Step-by-Step: How Banks Verify Your Income for Housing Loan Approval

Step 1: Collection of Financial Documents

After receiving your loan application, the bank first collects all financial documents to check your earning history. They make sure your income matches the loan amount requested under Apni Chhat Apna Ghar Scheme 2025.

Step 2: Cross-Verification with Employer

The next step involves employer verification, where banks call or send an official verification letter to your company. This confirms that your job title, salary, and employment duration are genuine.

Step 3: Review of Bank Statements

Banks then carefully analyze your 6–12 month bank statements. Any irregular deposits, overdrafts, or bounced cheques can affect the decision. Consistent salary deposits indicate financial stability.

Step 4: Tax and FBR Data Verification

Most banks in Pakistan now coordinate with the Federal Board of Revenue (FBR) to confirm if your declared income matches your tax record. If discrepancies are found, your housing loan can be delayed or rejected.

Step 5: Credit History and Repayment Capacity

The bank checks your repayment history through eCIB (Electronic Credit Information Bureau) of the State Bank of Pakistan. This report shows previous loans, credit cards, or missed payments.

Step 6: Employer or Business Visit (if needed)

In some cases, bank officials visit your office or business location to verify authenticity. This is common for applicants under government schemes like Apni Chhat Apna Ghar.

Benefits of Income Verification

| Benefit | Description |

|---|---|

| Ensures Loan Repayment Ability | Prevents future default and financial stress |

| Increases Trustworthiness | Builds confidence between bank and borrower |

| Eligibility for Better Rates | Transparent income records lead to lower markup |

| Quicker Approval Process | Verified income means faster documentation |

| Prevents Fraudulent Claims | Protects banks and genuine applicants |

Tips to Pass Income Verification Easily

- Submit genuine documents only. Any mismatch between salary slip and bank deposits can raise red flags.

- Keep salary consistent. Avoid sudden unexplained cash deposits before loan applications.

- Ensure FBR filing is updated. Filing annual income tax returns increases credibility.

- Get an employer verification letter on official letterhead.

- Avoid unnecessary personal loans or credit card debt before applying for a housing loan.

Check Also: Housing Loan Interest Rate Comparison for 2025 – Full Breakdown of Banks & Schemes

Common Reasons for Income Verification Failure

- Fake or incomplete salary slips

- Mismatch between declared income and bank records

- Employer unregistered or unverifiable

- No active tax record

- Poor credit history or unpaid loans

Importance of Income Verification in Apni Chhat Apna Ghar Scheme 2025

Under Apni Chhat Apna Ghar Scheme 2025, the Punjab government ensures transparency in the housing loan process. Participating banks like National Bank of Pakistan (NBP), Bank of Punjab (BOP), and HBL require strict income verification. This step ensures that subsidies and low-markup loans are given to eligible citizens only.

Applicants can apply online through apnichatapnaghar.pk to check eligibility and prepare documents in advance for smooth approval.

Check Also: How to Apply for Apni Chhat Apna Ghar Scheme 2025 – Complete Step-by-Step Guide

8 Frequently Asked Questions (FAQs) about Apni Chhat Apna Ghar Scheme 2025:

1. Why do banks verify income for housing loans?

To ensure applicants can repay monthly installments without financial stress.

2. How much income is required for a home loan in Pakistan?

At least Rs. 35,000–50,000 monthly, depending on bank and loan size.

3. Can I apply without a salary slip?

Self-employed persons can use business bank statements and tax returns instead.

4. Do banks call employers for verification?

Yes, most banks confirm job details directly with your HR department.

5. How long does the income verification process take?

Usually 7–15 working days after submitting all documents.

6. What if my income doesn’t match my bank statement?

Your loan may be delayed or rejected; always maintain clear salary records.

7. Can government employees get faster approval?

Yes, because their income is easily verifiable through official service records.

8. Does Apni Chhat Apna Ghar require income verification?

Absolutely — it’s a mandatory step to qualify for subsidized housing loans.

Conclusion – Income for Housing Loan Approval

In short, banks verify income for housing loan approval to confirm an applicant’s repayment ability and financial honesty. If your documents are genuine, tax records are up-to-date, and salary deposits are consistent, you can expect a smooth approval under Apni Chhat Apna Ghar Scheme 2025. Preparing in advance saves time, builds credibility, and helps you achieve your dream home with confidence.