Interest-Free Loans for Farmers Under CM Punjab Kisan Card 2025 Full Details & Eligibility

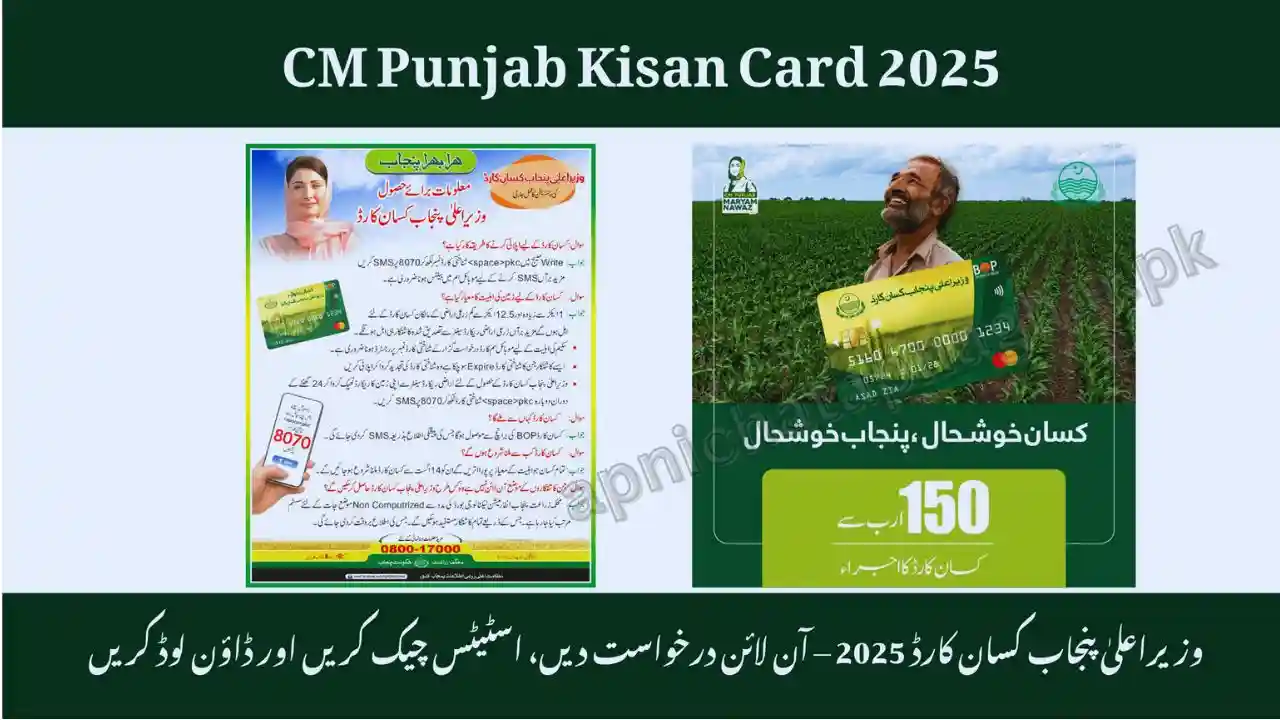

The CM Punjab Kisan Card 2025 has emerged as one of the biggest financial support initiatives for farmers in the province, offering interest-free loans to help them manage crop expenses without falling into the trap of high-interest moneylenders. Under this scheme, eligible farmers can access zero-markup loans for seeds, fertilizers, pesticides, diesel, irrigation, and machinery rental, directly through their Kisan Card.

The interest-free-loans-under-punjab-kisan-card-2025 Unlike traditional bank loans that involve heavy paperwork and hidden charges, this new model allows farmers to withdraw and repay in easy installments without paying any extra amount. This is a major shift in agricultural financing, as it protects farmers from debt cycles that previously forced them to sell their crops at low prices due to urgent repayments.

Read Also: ACAG Installment Calculator 2025 Estimate Monthly Payments Online

The interest-free-loans-under-punjab-kisan-card-2025 has partnered with ZTBL, Bank of Punjab (BOP), and HBL to facilitate these loans. With a digital verification process, farmers receive loans through ATM or POS transactions, making the system transparent and accessible even in remote areas.

The Kisan Card zero markup loan for both Rabi and Kharif crop seasons, allowing farmers to borrow multiple times a year as long as they repay within the approved repayment cycle. The government also plans to expand this facility to vegetable growers, livestock farmers, and orchard owners in future phases.

Kisan Card zero markup loan One of the biggest advantages is that no collateral or guarantor is required for small-scale loans only land record verification and biometric authentication are needed. This makes the scheme ideal for poor and middle-income farmers who were previously denied access to bank financing.

Check Also: Common ACAG Document Mistakes That Lead to Rejection – Checklist 2025

This article explains complete eligibility, benefits, application method, FAQs, and key terms so that every farmer can take full advantage of this interest-free loan facility in 2025.

✅ Eligibility Criteria for Interest-Free Loans:

- Must be a resident of Punjab with valid CNIC.

- Must be a registered Kisan Card holder.

- Landowner or tenant farmer with verified PLRA land record.

- Mobile SIM must be registered on applicant’s CNIC (BVS verified).

- Applicant must not be a bank defaulter or blacklist case.

- Previous loan repayment (if any) must be cleared on time.

- Minimum 18 years of age and physically capable of farming.

- Must agree to repay loan within approved crop cycle.

🌾 Key Benefits of Interest-Free Loans Under Kisan Card

- Zero markup — repay only the principal amount.

- Instant digital approval through biometric verification.

- No collateral or guarantor required for small-scale loans.

- ATM and POS withdrawal facility for easy access.

- Can be used for seeds, fertilizers, pesticides, and fuel.

- Multiple loan cycles allowed within a year.

- Special priority for small farmers and women applicants.

- Eligibility for future subsidy-based schemes automatically.

📝 How to Apply for Interest-Free Loans Under CM Kisan Card

- Visit your nearest ZTBL / BOP / HBL branch with CNIC & Kisan Card.

- Request “Interest-Free Loan Application” from the counter.

- Provide land record or tenancy proof for verification.

- Complete biometric authentication at bank desk.

- Select desired loan limit according to crop requirement.

- Bank processes the request and issues approval SMS.

- Withdraw loan amount using ATM, POS, or Agri Dealer.

- Repay within 3–6 months (Rabi / Kharif cycle) to re-apply again.

FAQs:

Q1: What is the maximum loan limit under interest-free scheme?

Small farmers can get Rs 150,000, while regular users up to Rs 3 Lakh based on category.

Q2: Do I need to submit any security or property documents?

No collateral is required — land record verification is enough.

Q3: How many times can I take a loan in one year?

You can apply once per crop season, and then reapply after repayment.

Q4: Is there any fine for late repayment?

If repayment is delayed, future eligibility may be suspended temporarily.

Q5: Can livestock or poultry farmers apply?

Yes, feeding and shed expenses are also covered in extended categories.

Q6: Can women farmers get separate quota loans?

Yes, widows and female landowners are given priority approval.

Q7: How will I be notified about loan approval?

You will receive SMS confirmation from bank or agriculture department.

Q8: Do I need to have a bank account?

Yes, but the bank can create one during verification if needed.

Q9: Can two members of the same family apply separately?

Yes, if both have separate CNIC and verified land share.

Q10: Can I reapply if rejected once?

Yes, after correcting the issue limiting your approval.

Conclusion:

The Interest-Free Loan Scheme under CM Punjab Kisan Card 2025 is a historic step toward financial freedom for farmers. Instead of relying on informal lenders who exploit them during sowing seasons, farmers can now borrow safely, digitally, and without extra charges.

This initiative ensures that even the smallest farmer can access capital without worrying about hidden costs or harassment during recovery. It also helps them focus entirely on cultivation and yield improvement, rather than worrying about loan pressure.

The digital nature of the scheme means that every withdrawal and repayment is recorded, ensuring transparency and fairness. Those who maintain good repayment history will be eligible for even bigger support schemes in the future.

If implemented effectively, this system has the potential to transform Punjab’s agriculture sector, making it more stable, modern, and profitable. Farmers must take advantage of this opportunity by registering and availing the loan responsibly.

In simple words, this is not just a loan — it is a lifeline towards debt-free farming. The doors are open — step forward and claim your right to financial support!